Last Updated: 7/26/23 | July 26, 2023

Travel insurance is one of the most important things you’ll buy for your trip — no matter how long you are going away for. It is a must-have and I never leave home without it.

Yet so many travelers I talk to travel without it — often because they don’t quite understand what it is and what it does. There are a lot of misconceptions about travel insurance out there and those misconceptions are putting people in danger.

Today, I want to address those questions, concerns, and misconceptions.

Personally, I always buy travel insurance when I travel. After all, we get home insurance, life insurance, health insurance, and car insurance. Why would we not cover ourselves when we’re abroad?

Travel insurance was there when I popped an eardrum in Thailand.

It was there when I broke my camera in Italy.

It was there when a friend had to go home after her father died.

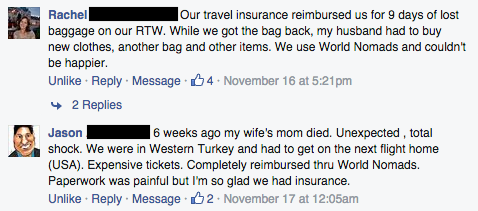

And it was there for these people too:

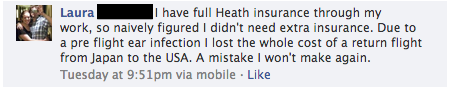

But not this person who decided not to get it:

Buying travel insurance is a must. But since it is a confusing topic (try reading New York insurance law for fun. I did. It’s not fun), today I want to answer the common questions about travel insurance. These questions pop up in my inbox all the time and are the greatest points of confusion on the subject.

Table of Contents

- What is Travel Insurance?

- Is Travel Insurance Just Health Insurance?

- Can Go See a Doctor When I Want?

- Can I Get Treated for an Illness I Already Have?

- My Credit Card Offers Some Protection. Isn’t That Good Enough?

- How Does Insurance Actually Work?

- What About Obamacare

- Why Are the Reviews Bad?

- I Got Drunk and Hurt Myself. Will I Be Covered?

- Does Travel Insurance Cover Me in My Home Country?

- I’m a Senior. What Should I Do?

- Will Travel Insurance Send Me Home If I Get Injured or Sick?

- What About COVID-19?

- My Recommended Travel Insurance Company

1. What is Travel Insurance?

Travel insurance provides support, compensation, and medical care when things go wrong on the road. Depending on your policy, it could provide support and compensation if your luggage is lost, if you slip and break a bone hiking, or if you need to return home early due to a death in the family.

It’s a financial safety net for emergencies while you’re abroad.

Contrary to popular belief, travel insurance is not a substitute for health insurance in your home country — nor is it a license to be foolish! (Also, travel insurance pretty much unilaterally excludes any mishaps that occur while you’re under the influence of alcohol or drugs.) It’s your emergency parachute should something terrible happen while you’re traveling.

2. Is Travel Insurance Just Health Insurance?

No, it’s so much more than that. While there is a medical component for sudden illnesses and accidental injuries, it can also cover all sorts of additional incidents, such as:

- Trip cancellation

- Lost/Damaged/Stolen possessions

- Emergency evacuation

- Expatriation should there be a natural disaster

- Trip interruption or delay

Travel insurance is for all-around emergencies, not just medical ones.

3. Is Travel Insurance Similar to Health Insurance? Can I Go See a Doctor When I Want?

Travel insurance is not a replacement for health insurance. It’s there for unexpected emergencies only, not regular checkups. And should you need to be sent home due to a health emergency, it will be your regular health coverage that kicks in once you’re back in your home country.

For that reason, you’ll need to make sure you have both travel insurance (for when you’re abroad) and regular health coverage (in case you get sent home with an injury)

Break a leg? Pop an eardrum? Get food poisoning or dengue? Travel insurance has you covered.

Want to go see a doctor for a physical or get a cavity filled? You’re on your own.

(If you’re a digital nomad or expat, check out SafetyWing and Insured Nomads, which both have plans that are akin to health insurance.)

4. Can I Get Treated for an Illness I Already Have?

As a general rule, most travel insurance plans don’t cover pre-existing conditions. If you get sick on the road, travel insurance is there for you. But if you need medication for an ongoing chronic disease or a medical condition you knew of before you bought the policy, you could be out of luck.

Moreover, if you get sick under one policy and then you extend it or start a new policy, most insurers will consider your illness a pre-existing condition and won’t cover it under your new policy.

In short, pre-existing conditions are generally not covered unless you find a specific plan that provides coverage for them.

5. My Credit Card Offers Some Protection. Isn’t That Good Enough?

Travel credit cards, even the very best ones, offer only limited protection. Some cards offer coverage for lost or stolen baggage, delays, and trip cancellation — but only if you booked your trip with that specific card.

In my experience (and I’ve had dozens of travel credit cards over the years) even if your card covers some things, that coverage limit is often very low. Plus, very few cards cover medical expenses, and even those that do provide limited coverage. This all means you’d have to pay out of pocket (and you’ll be surprised at just how expensive that can be!).

Bottom line: don’t rely on credit card coverage. While it’s nice to have its protection as a backup, I wouldn’t (and don’t) rely on credit cards for my primary coverage when abroad. It’s not a smart choice.

6. How Does Insurance Actually Work? Do They Mail Me a Card I Can Show the Doctor?

If you experience a major medical emergency that requires surgery, overnight hospitalization, or emergency repatriation, then you (or someone else) would contact your travel insurance company’s emergency assistance team. They can then help make arrangements and approve costs. Every insurance company has a 24-hour contact number you can call for emergencies. I always suggest travelers save this number in their phone before departure just to be safe.

For all other situations, you need to pay for the costs upfront, collect receipts, and then make a claim for reimbursement from your insurer. You’ll pay out of pocket and then submit documentation to the insurance company after the fact (so there’s no need to show a card to the doctor).

Be sure to keep all documentation, file any necessary police reports, and save all receipts. Companies don’t reimburse you based on your word. Keep documentation!

7. What About Obamacare? How Does That Affect Everything?

For Americans, the ACA, or “Obamacare,” covers you only in the United States, and since travel insurance is not a replacement for health insurance, it doesn’t get you out of any state-based requirements for health insurance.

While there is no longer a nationwide tax penalty for not having health insurance, some states still do charge one. Be sure to contact a tax accountant or the ACA hotline number for more information.

Also keep in mind that, if you need to be sent home due to an injury, travel insurance will not cover your bills upon arrival back to your country of residency.

8. I Read Reviews Online. All These Companies Suck. What’s Up With That?

I’ve talked with hundreds of travelers over the years about insurance and received thousands of emails from people who have had insurance issues. While there are some legitimate concerns, the overwhelming majority of people I interact with haven’t read the fine print of their policy. People buy a plan, don’t read the exact wording, and then make (incorrect) assumptions about their coverage.

Naturally, they scream bloody murder when their assumptions don’t match up with reality and go on a digital tirade, leaving bad review after bad review.

And, to be honest, most people don’t write good reviews when they are helped. On the Internet, we love to scream our displeasure but rarely do we go out of our way to leave a positive review of something.

So take online reviews of insurance companies with a grain of salt. I’ve read them and most of the time, I think, “You didn’t read your policy!”

I’m by no means an insurance company defender, but if you’re going in with no documentation, no proof you owned what you lost, or you want to make a claim for something that is specifically excluded on the policy, you should expect to get denied.

Is the reimbursement process fun? No. It’s a lot of paperwork and back-and-forth emails with the insurer. But when you have all your ducks in a row, you get reimbursed.

Here’s a list of my suggested insurance companies to help you get started. They’re reputable and reliable and can save you a lot of money should an accident happen.

9. I Got Drunk and Hurt Myself. Will I Be Covered?

Probably not! If you are doing something foolish (whether you’re drinking or not), insurance companies will want to know if putting yourself at unnecessary risk led to the injury. If, after investigating, they find you did, they can deny your claim. That’s not to say that they expect you to be sober your entire trip, but let’s just say you’re unlikely to get reimbursed if you’re drunk and decide that it would be a good idea to stand in the middle of the road and play chicken.

So, don’t be foolish!

10. Does Travel Insurance Cover Me in My Home Country?

Some travel insurance can cover you at home. For example, World Nomads travel insurance covers you either 100 miles from your permanent address (for U.S. residents), outside your home province (if you’re Canadian), or outside your home country (for everyone else).

It depends on your policy, and there are always conditions on when the coverage starts and ends and where you can travel to, so check this carefully first. Some companies let you be in your home country for a short period, others won’t cover you at all. So read the fine print!

11. I’m a Senior. What Should I Do?

Unfortunately, insurance companies don’t like covering seniors as they view them as high risk. Therefore, it’s a lot harder for older travelers to find comprehensive coverage. For seniors, use Insure My Trip, an online marketplace that searches over 20 different insurance companies to help you find the best policy for your needs. It’s the best place to get insurance for anyone over 65. Just expect prices to be much higher than policies for younger travelers, as older travelers pay a premium due to their age.

You can read more about travel insurance for seniors in this post.

12. Will Travel Insurance Send Me Home If I Get Injured or Sick?

Under most circumstances, travel insurance will not repatriate you to your home country. In a nutshell, travel insurance is there to make sure you get the medical assistance you need should an emergency arise. Usually, that means sending you to the nearest acceptable facility — they don’t have to send you home.

So, if you break your leg hiking you’ll be taken to the nearest suitable facility and patched up. After that, the onus is on you to get home. Your policy will likely reimburse you for any part of your trip that you cancel due to your injury but it won’t pay for you to go home early (unless you have a life-threatening injury that requires advanced medical care).

If you feel this isn’t enough coverage and want additional medical transport and repatriation coverage, use a service like Medjet. They’re a membership program with affordable annual (and short-term) policies that include medical transport coverage that’s more comprehensive than what you’d find in your average travel insurance policy.

You can learn more about the program in my Medjet review.

13. What About COVID-19 and Other Pandemics?

As many found out the hard way in 2020, travel insurance historically has not covered pandemics. While many companies have made changes to their pandemic coverage (such as SafetyWing and Medjet), pandemic and COVID-19 coverage is not universal.

Be sure you understand exactly what COVID/pandemic coverage is offered before you book. Specifically, you’ll want to know whether you’re covered only for medical issues or if you have cancellation/trip interruption coverage as well.

For policies that give blanket coverage (i.e. “cancel for any reason” policies) check out Insure My Trip.

The #1 Travel Insurance Company for Travelers

My favorite travel insurance company is SafetyWing. SafetyWing offers convenient and affordable plans tailored to digital nomads and long-term budget travelers. They have cheap monthly plans, great customer service, and an easy-to-use claims process that makes it perfect for those on the road.

I use them because I can purchase and renew my insurance policy online in a matter of minutes, they have a very friendly and responsive staff who answer questions and help solve problems via social media, they have great customer feedback, and most importantly, they provide a lot of coverage at a super affordable price.

You can use the widget below to get a quote today:

I’ve used travel insurance since my first round-the-world trip, and it’s helped me, my friends, and readers of this website. I can’t stress its importance enough.

I can also not stress enough that you need to read the fine print of your plan. Remember, travel insurance companies are for-profit. They will only reimburse you if your situation fits within the scope of your policy. The only way to know if it does is to read your plan.

Having had to use my insurance several times over the years, I genuinely hope you’re never put in a situation where you need to use yours. However, if something does happen and you need to make a claim you’ll be happy you spent the money.

Don’t avoid buying travel insurance because you read a bad review or think you’ll be OK. Accidents happen to the best of us.

Travel insurance is a safeguard against the unexpected. So, be prepared. You won’t regret it.

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner. It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- Insure My Trip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip?

Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.